All states require car owners to purchase auto insurance. In California Drivers are required to have at least a minimum liability coverage for bodily injury and property damage claims. That minimum limit is $15,000 per person, $30,000 per accident for bodily injury. The minimum liability limit for property damage is $5,000.

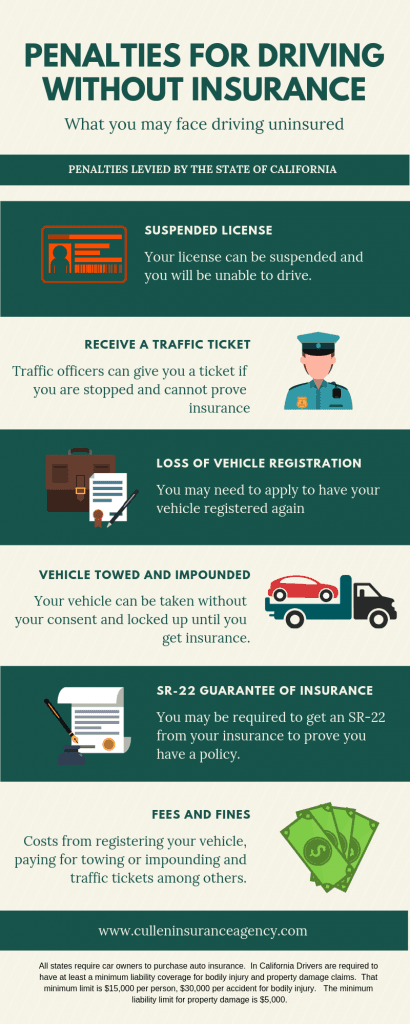

There are penalties levied by the State of California. But driving uninsured can have other seriously negative impacts that go beyond what the state imposes.

Common Penalties for Driving Without Insurance

Here is a list of possible penalties you may face for driving without insurance

- Your License will be suspended

- You may receive a traffic ticket

- Loss of vehicle registration

- Vehicle Towed and impounded

- May be required to carry an SR-22 guarantee of insurance

- Fines and fees related to registering your vehicle again, towing costs, and impoundment.

Additionally, many states require drivers to carry uninsured/underinsured motorist coverage. Uninsured/underinsured motorist coverage covers expenses stemming from an accident involving another driver (at fault) who has little or no insurance.

Costs for towing and impounding.

We spoke to Clark and Howard Towing in Lancaster who informed us of the following rates for towing and impounding

$141-230/hour for towing

$37-$48/day storage

Prices depend on if it’s the CHP or Sheriffs department making the call and if the call comes in before or after hours. CHP rates are higher than the Sheriff’s department.

The Cost of an Accident for an Uninsured Driver

While the legal penalties are very serious when it comes to driving without car insurance, you face even greater risk when you’ve been in an accident.

If you cause damage or injury to yourself you obviously face the cost of dealing with those, and they can be high. However, if you were to cause injuries or property damage to another person(s), you could be held liable for those costs. The other driver can sue you for damages.

If you don’t have the amount of money to cover their costs, your assets could be taken

Those assets Include:

- Home

- Savings

- Garnished Wages

- Other Investments

- Other assets

The risk of driving without insurance is far too great. While the costs of premiums may seem high, consider the hit your finances could take if something happened while you were uninsured.