California is going through a period of intense yearly wildfires. This has led to a record $12.8 billion in insurance claims. Insurers are starting to get nervous about insuring homes near fire-prone areas and many homeowners are finding that their policies are not being renewed or their premiums have increased.

With this post, we aim to address how insurance companies calculate the cost of homeowners policies in fire-prone areas. There are two important things to keep in mind:

- The cost of a homeowners policy will vary according to the risk

- The greater the risk of loss (damage) the higher the premiums will be.

Is my home a fire risk?

Before we get to how insurers calculate cost, let’s answer a very important question – should you panic?

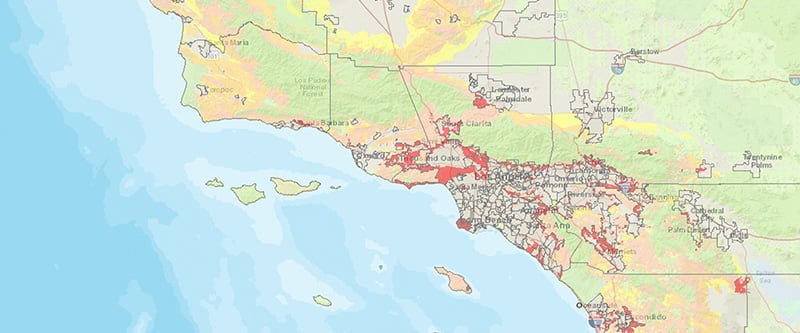

Cal Fire has a program called FRAP (Fire and Resource Assessment Program) that assess California for what are the most fire prone area. They have an interactive map that you can use here. Their online resources will give you a greater understanding of how much risk your property is in.

Here’s a quick guide to the acronyms used on the interactive map:

| Acronym | Meaning |

| SRA | State Responsibility Area. |

| LRA | Local Responsibility Area. |

| FHSZ | Fire Hazard Safety Zone |

| GIS | Geographic Information Survey |

| VHFHSZ | Very High Fire Hazard Safety Zone |

FRAP also has a number of fact sheets and articles to help protect your home from fire. We recommend watching this video for more information:

Remember, insurance is there for when something terrible has occurred. You should take steps to prevent catastrophic damage to your home. Cullen Insurance would prefer to only speak to you under good terms.

How Do Insurance Companies Measure Fire Risk

Insurance companies usually measure fire risk in two ways:

- Distance to brush

- Density of brush

The greater the distance and the less dense (sparse) the brush the lower the premium. Brush within 100 feet and extremely dense (thickly packed) will, of course, cost the highest premium.

What is meant by brush?

Other factors

As well as brush distance and density, an inspector will also consider the following in giving you a fire line score.

- Topography

- Wind patterns

- Distance to water source

- Distance to a local fire station (volunteer fire stations often do not count)

- Roof type

What insurance is available?

There are two types of insurance that you can get that cover fire.

The preferred homeowners policy

This is the cheapest policy that includes fire and not everyone will qualify based on

- The dwelling must be within 5 miles of the closest fire department and have a fire hydrant within 1000 feet.

- With homes in the more fire-prone areas, this criterion may not be enough. Many companies will add an additional requirement of distance to brush. There are companies (not all) that will write a preferred policy if the distance to brush is less than 1,000 feet.

The high risk homeowners policy

When your home/dwelling does not fall within the guidelines for a preferred homeowners policy it will typically be written with a company that specializes in High Risk policies.

There are two main avenues for this. The first is the California Fair Plan and the second will be non-admitted carriers. Most preferred carriers in the state can also write a policy for you with the California Fair Plan. A few companies, such as Allstate, are also able to write policies through non-admitted carriers. These policies will rate (set premium) according to the risk.

California FAIR Plan vs a non-admitted carrier policy

Get a California FAIR plan policy if you want minimal coverage at a low price.

Get a non-admitted carrier policy if you want comprehensive coverage with your high-risk property.

The California FAIR plan

This

What the California FAIR plan covers:

- Fire or Lightning, Internal Explosion.

- Windstorm or Hail, explosion, riot or civil commotion.

- Aircraft (including self-propelled missiles and spacecraft), Vehicles.

- Smoke (meaning sudden and accidental damage from smoke).

- Volcanic Eruption.

- Vandalism or malicious mischief

What the California FAIR plan does NOT cover

- Water damage

- Theft

- Liability

As you can see, the perils (cause of damage) that the California Fair Plan offer

Getting a Difference In Conditions (DIC) with your fair plan

A DIC policy can be purchased through most preferred carriers (including Allstate). A DIC, also known as a wrap-around, is a seperate policy and picks up the coverages that the FAIR plan leaves out.

Cullen Insurance does not generally recommend a DIC because there are no real savings over the high-risk policies from the non-admitted carrier. It can be problematic if your insurance is impounded, most mortgage companies will only pay one policy. That leaves you with the decision of which policy you’re going to pay and the task of remembering to pay it. Plus most DIC policies don’t come with monthly payment options. Finally, multiple policies can complicate the claims process because you have to determine which policy to put the claim in.

A DIC plan makes the situation twice as complicated while typically giving you no real savings.

Non-Admitted Carrier

This is a single policy that will be as comprehensive as a standard homeowners policy. It includes coverage for personal liability, water damage and theft as well as fire all in one easy policy.

This policy is typically written through a broker, although some preferred carriers such as Allstate also has access. These carriers, that write high risk or specialty line policies, are not licensed to sell directly in California so write through a broker.

Allstate and Cullen Insurance mostly use North light Specialty as our non-admitted carrier. North Light Specialty gives you a handy breakdown of your fireline score to help you improve the chance of your belongings surviving a devastating fire.

Would you like to know more?

If you’d like to know more about protecting your house against fire you can give us a call at 661-948-4444 and one of our specialized insurance experts will help you make the best decision for your household.